Hey, so you're probably asking yourself now, "I wrote the wrong number in the 1099, can I fix it? I don't want to deduct less money I paid the guy. Why am I suffering?" And the answer is, don't worry about why, because A, you can fix it, B, there is no penalty, and C, it'll be all right, calm down. So how do you do it? Number one, either A, you can use software, or B, you can just follow the paper again, right? If you want to follow the paper again and go onto the website, request that form request again, the 1099 and 1096. Why? Because you've got to fix the 1099 by saying all the same information, name, address, social security number, but this time the right amount of money. And then, you've got to check that says "corrected" on the top middle/right corner. And once you do that, you're good. But now, remember to always sign the 1096, fill out all that information again, and send it together. If you don't send a 1096 together with the 1099, the IRS will disregard it. Why? Because you never signed it. It's not real until you sign it. So make sure you sign it with the 1096, mail it together, and you're good to go. The easy way of doing it, obviously, would be software. You know, just type in the right number and everything's done. Thanks. The average 1099 employment tax audit is probably not going to cost you $26,000. It's a lot of money for a small business. So stop worrying about things that don't matter, like incorporating. Don't incorporate in Delaware, and definitely don't incorporate in Nevada. Take care of important things, like your employment taxes. Messing it up means that you're going to...

Award-winning PDF software

Incorrect 1099 penalty Form: What You Should Know

Form 1099-Q: Report of Certain U.S. Business Income or Loss. A taxpayer may report one loss and be subject to a 280 penalty. Forms 1099-MISC and 1099-R — what is in each? Nov 24, 2024 — A taxpayer may report one (and any related) income and a loss, but there is no penalty for not filing a return. When filing a tax return as a nonresident alien or foreign corporation, the penalties for failure to file have been lowered. Forms 1099-MISC, 1099-R, G, and N Nov 25, 2024 — The penalties for failing to file an information return for any of the tax years beginning with 2024 (Form 1099-MISC) or 2024 through 2024 (Form 1099-R) have been reduced by two percentage points to 10% of the tax due, instead of 15%. For each such return that has been filed and paid, you'll face a 280 penalty. IRS: 1040 information return due April 15, 2023? (2018) Nov 25, 2024 — An information return filed 30 or more days overdue can be delayed because of a technical problem or a failure to provide all information. The deadline for such penalties is the next business day if the problem is fixed, or the following business day if the problem persists until payment. If the 1040 isn't made by April 14, the penalty imposed is 5 percent of the tax due for each of the 10 tax years ending on the date of the return. Form 6039: Payment of Tax on Exempted Business Interest Nov 25, 2024 — Interest or royalty tax on net exempt interest on property held in the United States by a U.S. business entity is exempt.

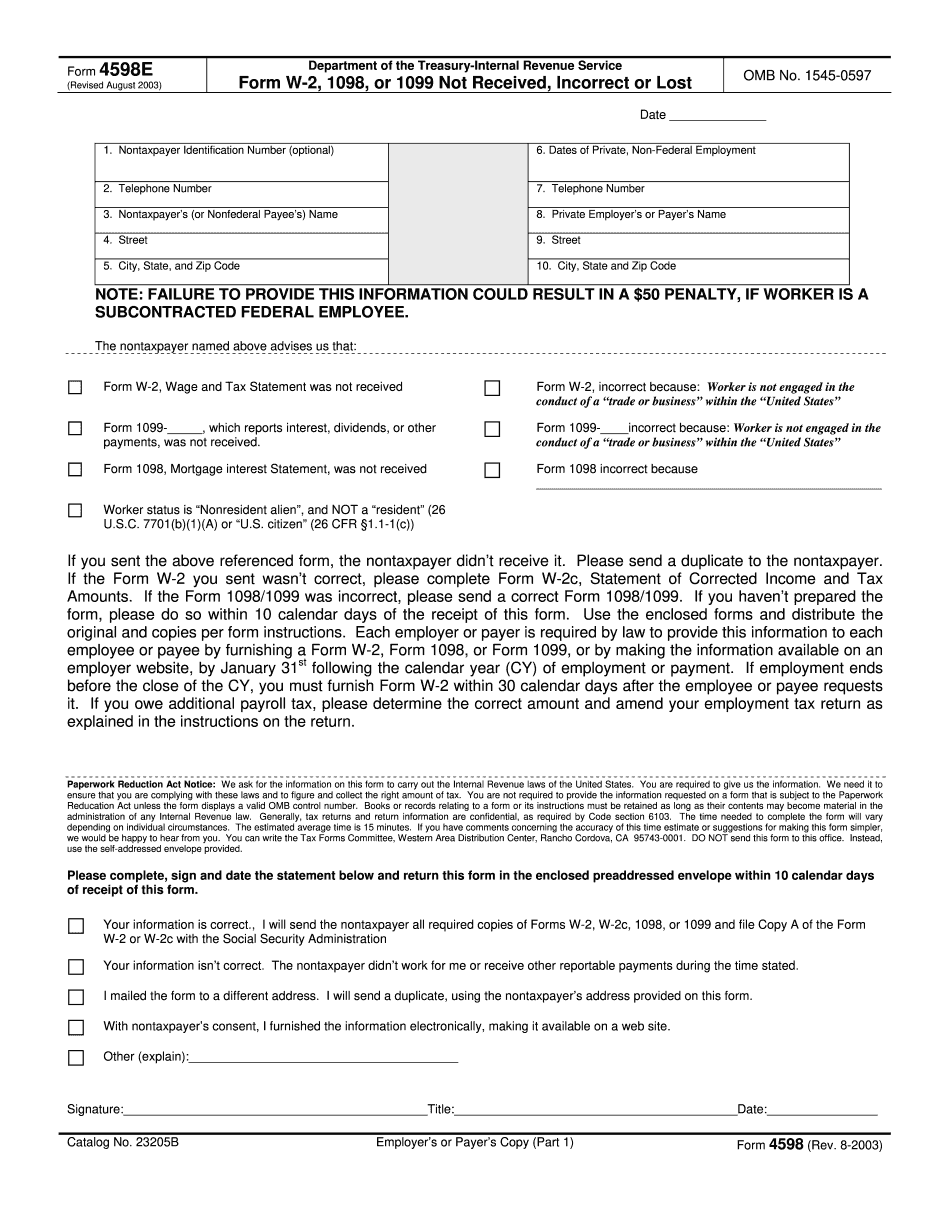

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 4598e, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 4598e online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 4598e by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 4598e from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Incorrect 1099 penalty